PROTO CORPORATION (the Company) announced that, for the term ending March 2018 (April 1, 2017 to March 31, 2018), it is estimated to incur the following impairment loss. Accordingly, the consolidated earnings forecast for the term ending March 2018, which was announced on October 30, 2017, has been revised as follows. In addition, loss on valuation of stocks of subsidiaries and affiliates related to non-consolidated earnings will be posted.

1. Regarding the incurring of impairment loss

(1) Regarding impairment loss

The collectability of receivables of TIRE WORLD KAN BEST CO., LTD. (hereinafter referred to as “TIRE WORLD KAN BEST”), which is a consolidated subsidiary of the Company, has been examined carefully while considering its recent business performance, etc. As a result, it is estimated that the Company will post part of fixed assets related to the business of TIRE WORLD KAN BEST (126 million yen) and the total amount of unamortized goodwill balance recorded when acquiring its shares (1,193 million yen) as impairment loss.

(2) Background for impairment loss

In April 2015, the Group reorganized TIRE WORLD KAN BEST, which sells mainly domestic tires, into a subsidiary, for the purpose of growing the automobile-related information business, which is the Company’s mainstay. The Company has strived to attain its business goals, by expanding its sales channels through the enhancement of EC sale, but its profit has been recently declining, mainly because of the delay in passing on the augmentation of procurement cost due to the escalating prices of materials for tires to selling prices since April 2017.

In these circumstances, the Company concluded at this moment that it would be difficult to recoup investment as initially planned, while considering the recent market environment and competition trends, and plans to post part of fixed assets and total amount of unamortized goodwill balance as impairment loss.

(3) Our future plan

In order to expand the domain of the automobile-related information business, which is the mainstay of the Group, the Company continuously aims to recover the performance of TIRE WORLD KAN BEST. The Company will enhance the efforts for recovering business performance by expanding sales channels through the improvement of utilization rate of MOTOR GATE Shopping, strengthening the distribution function by enlarging distribution centers, integrating or closing unprofitable shops, etc. in TIRE WORLD KAN BEST, to keep up with the trend of EC sale in the market of replacement tires.

2. Revision to Consolidated Earnings Forecast

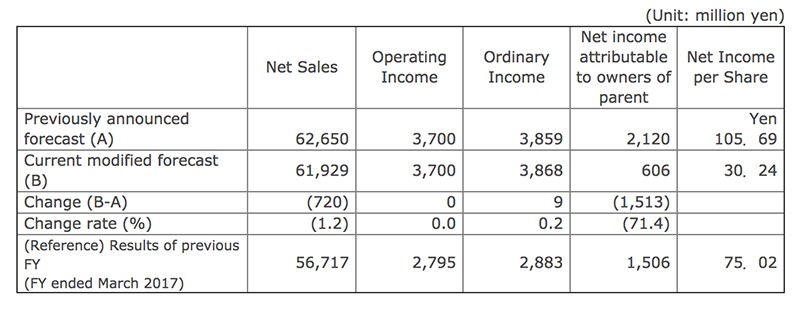

(1) Modifications of the consolidated earnings forecast figures for FY ending March 2018 (from April 1, 2017 to March 31, 2018)

(2) Reasons for revision

①Net Sales

As for TIRE WORLD KAN BEST, which sells mainly tires and wheels, the sales volume of tires was favorable, but unit selling price was lower than the estimate. As for Kings Auto Co., Ltd., which exports used cars, mainly the number of used cars exported to Myanmar was smaller than the initial estimate. Accordingly, the Company will revise the estimated sales for the term ending March 2018 to 61,929 million yen.

②Operating Income, Ordinary Income

Sales and gross profit are forecasted to fall below their respective estimates, while SG&A is estimated to be lower than the estimate. Accordingly, the Company will leave the estimated operating income for the term ending March 2018 unchanged from 3,700 million yen, which was announced previously, and revise the estimated ordinary income to 3,868 million yen.

③Net income attributable to owners of parent

In addition to the above mentioned factor, the collectability of receivables of TIRE WORLD KAN BEST, which is a consolidated subsidiary of the Company, has been examined carefully while considering its recent business performance, etc. and the Company will post part of fixed assets related to the business of TIRE WORLD KAN BEST (126 million yen) and the total amount of unamortized goodwill balance recorded when acquiring its shares (1,193 million yen) as impairment loss. Accordingly, the Company will revise the estimated profit attributable to owners of parent for the term ending March 2018 to 606 million yen.

3. Loss on Valuation of Stocks of Subsidiaries and Affiliates related to Non-consolidated Business Results

In addition to the reason mentioned in the above section 1, the net assets of PROTO MALAYSIA Sdn. Bhd. (hereinafter referred to as “PROTO MALAYSIA”), a consolidated subsidiary of the Company, declined, and so a loss on valuation of stocks of subsidiaries and affiliates of 1,970 million yen (1,809 million yen in TIRE WORLD KAN BEST and 160 million yen in PROTO MALAYSIA) is estimated to be posted as extraordinary loss in non-consolidated financial results, which will not affect consolidated results.

(Note) We will announce the definitive values of the consolidated results on Friday, May 11, 2018.

(Note) Although the earnings forecast figures in this document are calculated based on the information available as of the day of announcement, the actual earnings may be different from the above forecast figures due to uncertain factors that are inherent in the forecast.