At the Board of Directors meeting held on November 14, 2012, PROTO CORPORATION (the Company) made the decision to acquire shares in AUTOWAY Co., Ltd. (hereinafter referred to as AUTOWAY) and make it a subsidiary company. The details are as below.

1. Reason for Acquisition of Shares

The Company provides a variety of information services in order to benefit consumers, centered on Goo-net, the car portal site with the largest number of registered used cars in Japan. The Company’s core product Goo finished covering all areas in Japan in the previous fiscal year, and its operating base is currently being strengthened.

With this overwhelming position in the marketplace, the Company is working towards expanding its business areas in order to grow its automobile-related information business.

As part of this plan, the Company made AUTOWAY, which imports and sells tires for automobiles, a consolidated subsidiary company. AUTOWAY imports large volumes of high-quality tires from Taiwan, Republic of Indonesia, Republic of Korea and other locations and then sells them over the Internet, which has led to a steady increase in sales performance.

By acquiring AUTOWAY as a subsidiary, the Company can take advantage of its strength in collecting customers using the Internet and thus gain more contact points with users, while simultaneously using the Company’s media such as car portal site Goo-net to send users to AUTOWAY’s tire and wheel commercial site AUTOWAY LOOP, helping to further increase the scale of AUTOWAY’s business.

2.Transfer Method

The company will buy AUTOWAY shares from the existing shareholders.

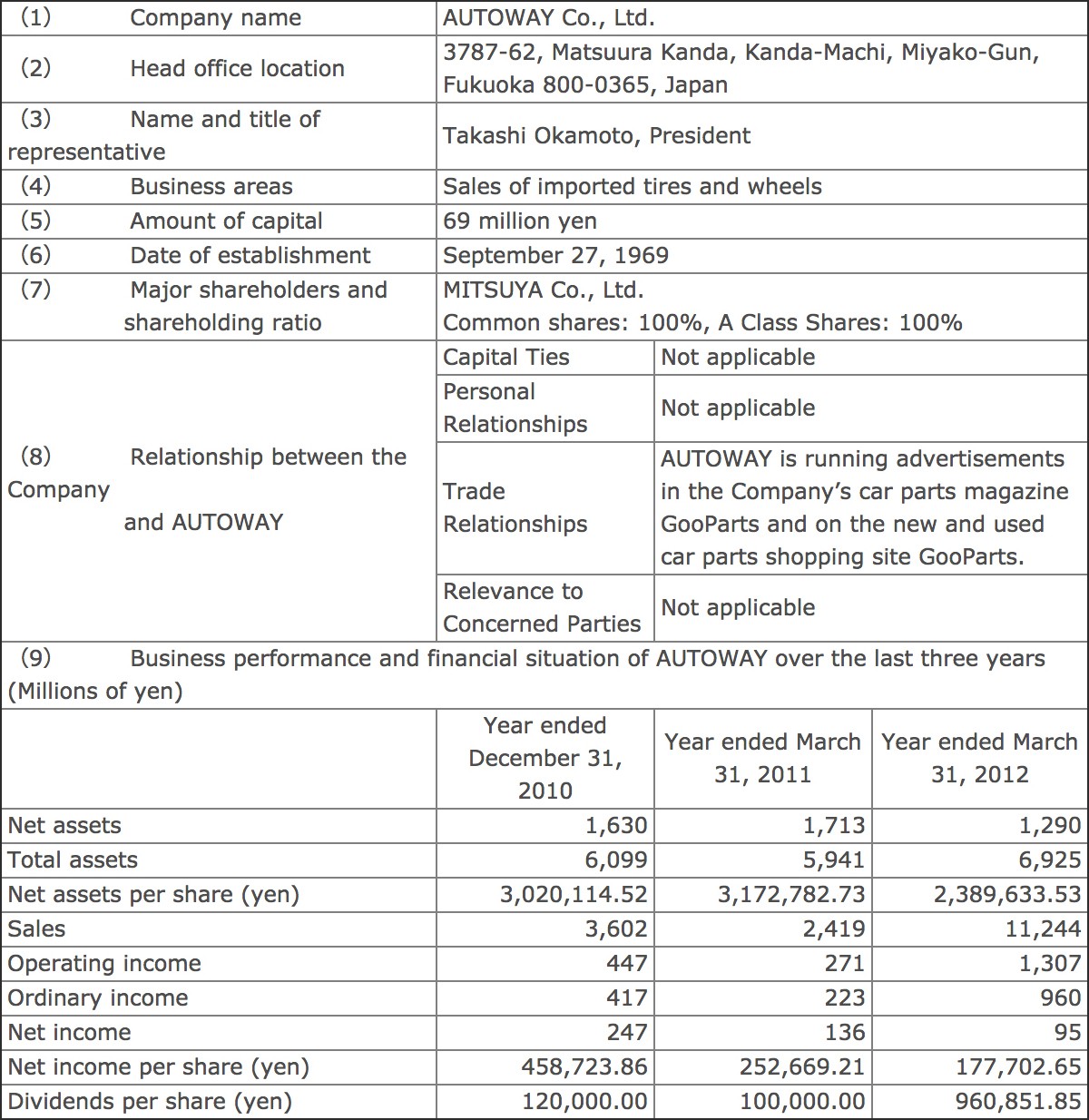

3.Overview of Acquired Subsidiary

Note: With the change to the end date for business years, fiscal year ended December 2010 has 4 month accounts and fiscal year ended March 2011 has 3 month accounts.

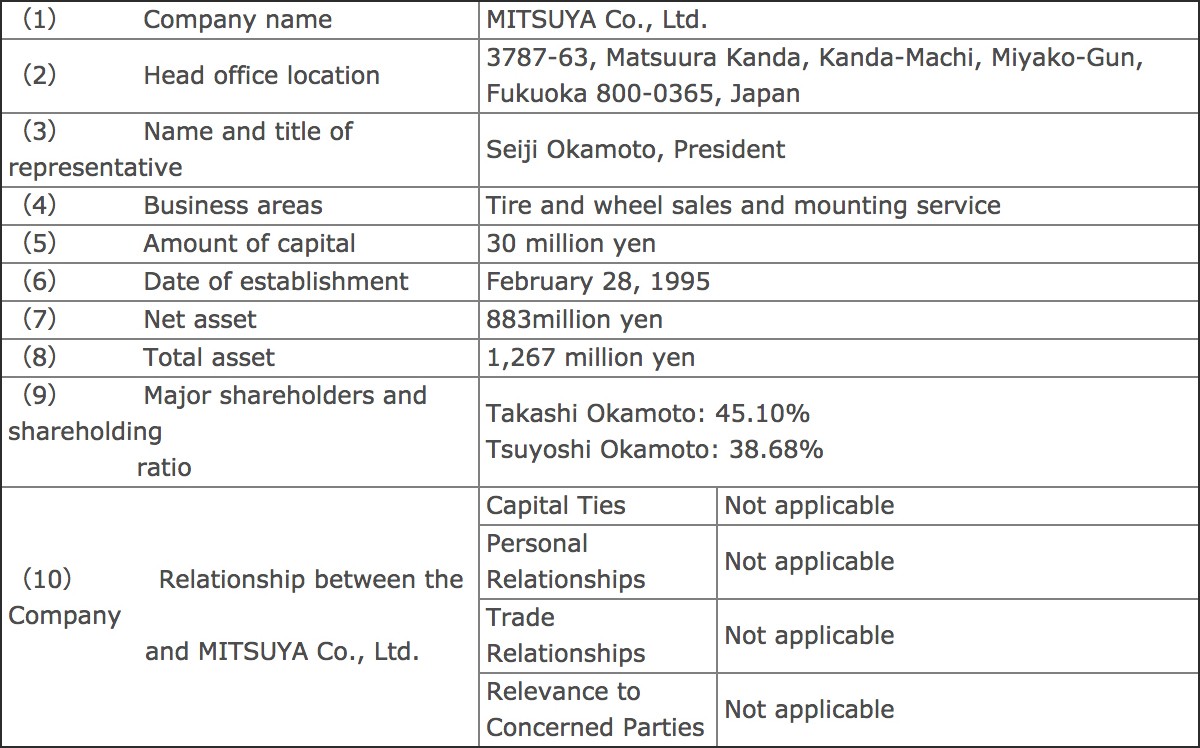

4.Overview of Stock Acquisition Partner

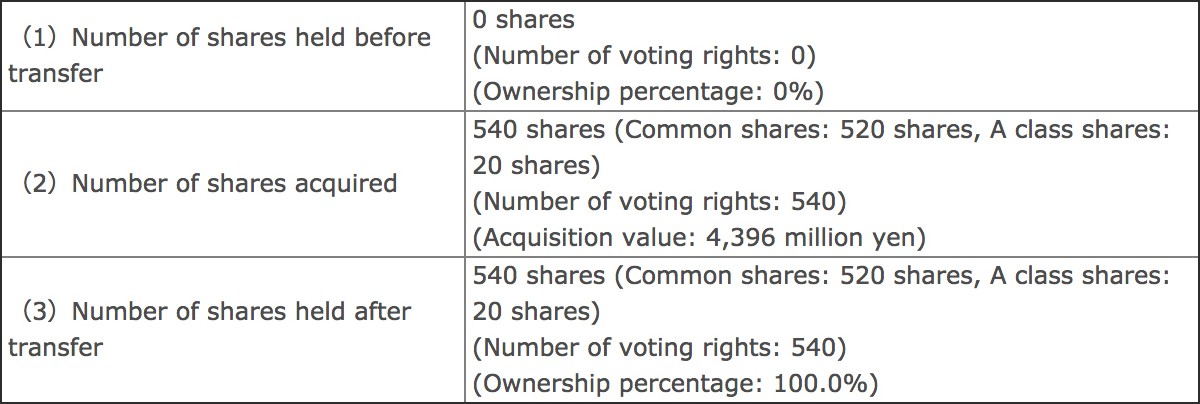

5.Number of shares acquired, value of acquisition, and status of stock ownership before and after acquisition (4)Basis for calculating acquisition value

(4)Basis for calculating acquisition value

The above acquisition value was calculated taking into consideration business synergy with the PROTO Group based on an appraised value calculated by an independent third party in order to ensure fairness and validity.

6.Time Schedule

Corporate resolution: November 14, 2012

Contract signed for purchasing shares: November 15, 2012 (scheduled)

Transfer date: April 1, 2013 (scheduled)

7.Financial Outlook

The influence of this transaction on the consolidated business results for the fiscal year ending March 2013 is expected to be insignificant.